Medicare enrollment can be very confusing for those enrolling for the first time. From being aware of the enrollment period to understanding the type of health coverage required; from finding out the various options available to being knowledgeable of the various scams related to Medicare – all this can cause stress and confusion. Choosing the right plan requires an individual assessment. A plan that is right for your spouse or friend may not be the right one for you. It would be a hassle for most to manage two different plans in the same household, but the potential savings make it worthwhile.

Medicare enrollment is automatic for certain groups; for others, it depends on when they become eligible and under what conditions. You are automatically enrolled if:

- You are receiving retirement benefits when you turn 65.

- You are receiving disability benefits but are still under 65 years of age.

Enrollment in Medicare Part A is automatic for most people at 65 years of age. However, you can enroll in Medicare Part A and/or Part B manually during your Initial Enrollment Period (IEP) that begins 3 months before your 65th birthday.

Keeping in mind the various options that are available and the confusion that the initial enrollment causes most people, here are some tips to help guide you through the process.

Be aware of your Medicare Open Enrollment Period

It is very important to be aware of when you can first enroll in Medicare – missing the date will incur extra costs and fees. You are eligible for enrollment from 3 months before to 3 months after your 65th birthday. For those already enrolled in Medicare, but wishing to change their plan, it can be done during the general Open Enrollment Period from October 15 to December 07.

Understand the different parts of Medicare

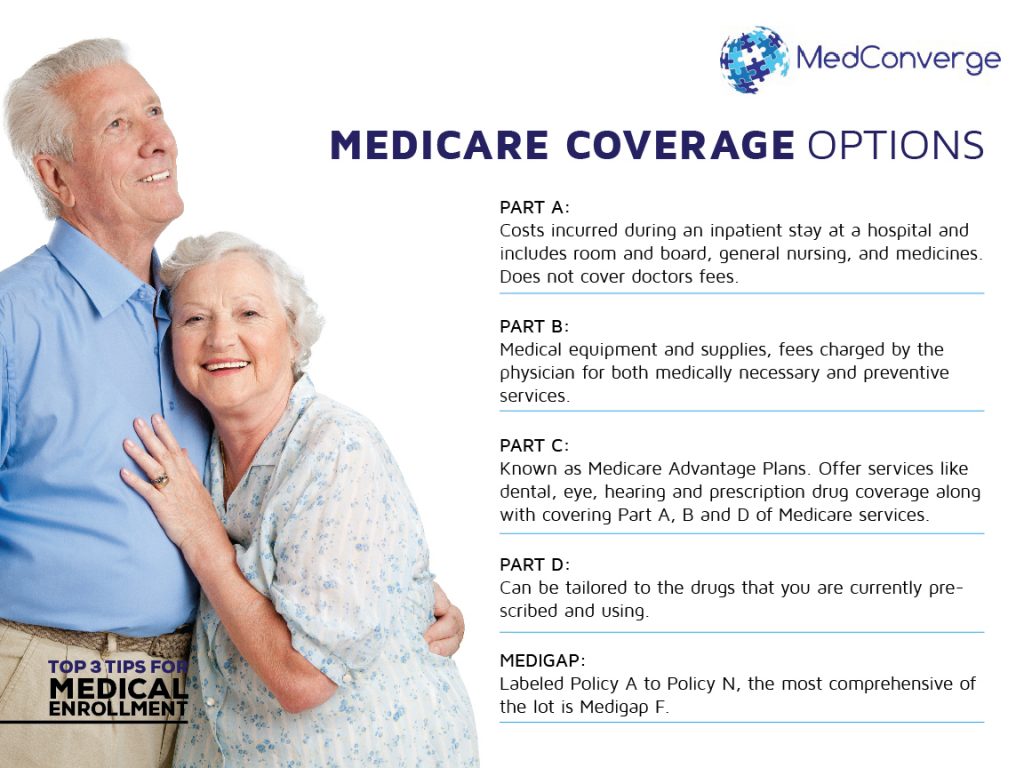

Medicare coverage is split into four parts – A, B, C and D, while the supplement plans are known as Medigap. It is important that you understand each of these parts and their importance.

- Medicare Part A: This covers costs incurred during an inpatient stay at a hospital and includes room and board, general nursing, and medicines. Remember that this does not cover your doctor’s fees. Also, long-term care hospitalization or skilled nursing facilities are only covered for a limited time. While Part A does not attract any monthly fee, there are co-insurance costs and deductibles involved.

- Medicare Part B: Covering durable medical equipment and supplies, this also covers fees charged by the physician for both medically necessary and preventive services. However, remember that this coverage attracts a monthly premium, co-insurance costs and an annual deductible.

- Medicare Part C: Known as Medicare Advantage Plans, these are offered by private entities like Blue Shield, Blue Cross and Humana. Structured in a similar manner as HMO and PPO plans, these offer services like dental, eye, hearing and prescription drug coverage along with covering Part A, B and D of Medicare services.

- Medicare Part D: Getting more specific, this plan offered through private health insurance companies covers the costs of prescription drugs. Different plans offer specific lists of drugs that are covered and thus can be tailored to the drugs that you are currently prescribed and using.

- Medigap: To cover the gaps in Part A and B, this policy is offered by private health insurance companies. However, eligibility for Medigap requires enrollment in Medicare Part A and B. Medigap offers different plans covering different costs. Labeled Policy A to Policy N, the most comprehensive of the lot is Medigap F.

Find out your health care needs

It is important that you are aware of your health care needs, considering the different options available through Medicare coverage. You need to be aware of both your current requirements and your probable near future requirements. Consult with your physician about what could be required in the near future with regard to your health care. Once you are aware of your needs, choosing the right plan will not be difficult.